The higher levels of new business were mostly attributed to

the start of new projects that had been delayed earlier in the coronavirus

pandemic and continued demand for residential building work.

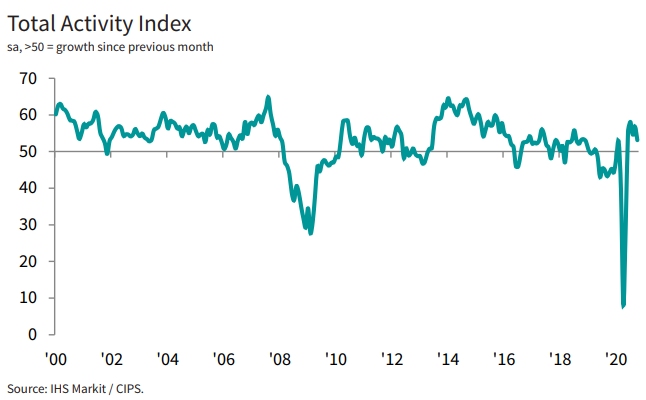

But the rate of growth in in output among construction

companies in October was at its lowest level since June, according to the latest

IHS Markit/CIPS UK Construction Total Activity Index for October. The index recorded

a score of 53.1 last month (where a score of 50.0 indicates no change), down

from 56.8 in September. The index has registered above the 50.0 mark in each

month since June.

This is not a paywall. Registration allows us to enhance your experience across Construction Management and ensure we deliver you quality editorial content.

Registering also means you can manage your own CPDs, comments, newsletter sign-ups and privacy settings.

Buyers reported that house building was the best-performing

area of construction activity during October (scoring 62.4). There was also

another rise in commercial activity (52.1), although it was its weakest level

of growth for five months. By contrast, civil engineering activity dropped for

the third month running (36.4).

The rebound in construction activity after the shutdowns

seen during the initial lockdown period continued to put pressure on supply

chain capacity in October. This was signalled by another sharp lengthening of

delivery times for construction products and materials, with the latest

deterioration in supplier performance the steepest since June. Construction

firms often noted that demand for building materials had outstripped supply in

October, which resulted in higher average cost burdens. The rate of input price

inflation accelerated to its fastest since April 2019.

Nonetheless, construction companies reported optimism

towards their prospects for the next 12 months, despite concerns about the

wider economic outlook. Around 45% of the survey panel anticipate a rise in

output during the year ahead, while only 14% forecast a reduction.

Tim Moore, economics director at IHS Markit, which compiles

the survey, said: "The construction sector was a bright spot in an

otherwise gloomy month for the UK economy during October. Another sharp rise in

house building helped to keep the construction recovery on track, albeit at a

slower speed than in the third quarter of 2020. Commercial work also

contributed to growth in the construction sector, while civil engineering

remained the main area of concern as activity in this category dropped for the

third month running.

"Supply chain difficulties persisted in October, as

signalled by a sharp lengthening of delivery times for construction products

and materials. Purchasing prices increased as a result of demand outstripping

supply for construction inputs, with the rate of cost inflation hitting an

18-month high in October.

"New orders improved at the sharpest rate for nearly

five years in October, suggesting a positive near-term outlook for construction

activity. However, survey respondents commented on renewed economic uncertainty

and concerns about the sustainability of the recovery as pent up demand begins

to wane."

Commenting on the findings, Mark Robinson, Scape Group chief

executive, said: “As England enters a second lockdown, the construction

industry remains the best-placed sector to drive economic recovery. however,

the ramping up of restrictions and the political turmoil in America is likely

to further dent interest in private infrastructure investment. As such, public

sector projects must continue to be at the forefront of government thinking.

With the full weight of government spending behind it, the construction

industry stands ready to deliver transformational change across the public

estate which will not only nurture the type of placemaking needed to stimulate

the return of private capital but also the social cohesion for a better society

on the other side of the pandemic.”