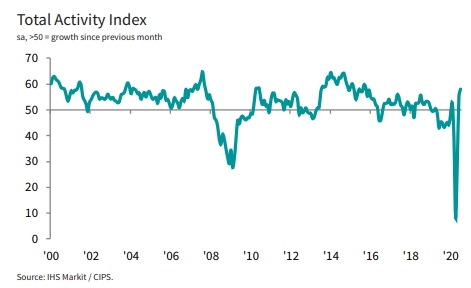

The IHS Markit/CIPS UK Construction Total Activity Index

reported a strong expansion of business activity last month, recording a score

of 58.1 (where 50.0 indicates no change).

That was up from 55.3 in June, as the construction industry

continued its return to work following the coronavirus lockdown.

The main driver of activity in July was residential

building, with activity increasing to the greatest extent since September 2014

as buyers reported the release of pent-up demand and reduced anxiety among

clients.

This is not a paywall. Registration allows us to enhance your experience across Construction Management and ensure we deliver you quality editorial content.

Registering also means you can manage your own CPDs, comments, newsletter sign-ups and privacy settings.

Commercial work and civil engineering both also expanded at

slightly quicker rates than in June, with the growth often attributed to the

catch-up of work that had been delayed, according to respondents.

Meanwhile, the survey found that new orders rose at their

fastest rate since February, although the rate of expansion remained softer

than that recorded for output levels.

And construction firms were optimistic overall about the

prospect of a recovery in business activity during the next 12 months. Around

43% of the survey period expected a rise in output over the coming year, while

only 30% forecast a fall.

Nonetheless, the rate at which companies shed jobs

increased, with one in three respondents (34%) reporting a fall in employment.

Input cost inflation reached its highest level since May

2019, with pressure on costs partly linked to stretched supply chains.

Tim Moore, economics director at IHS Markit, which compiles

the survey said: “Construction companies took another stride along the path to

recovery in July as a rebound in house building helped to deliver the strongest

overall growth across the sector for nearly five years. Civil engineering and

commercial activity are also back in expansion, which has been mainly due to

the restart of work that had been delayed during the second quarter of 2020.

"Survey respondents noted a boost to sales from easing

lockdown measures across the UK economy and reduced anxiety about starting new

projects. However, new work was still relatively thin on the ground, especially

outside of residential work, with order book growth much weaker than the

rebound in construction output volumes.

"Concerns about the pipeline of new work across the

construction sector and intense pressure on margins go a long way to explain

the sharp and accelerated fall in employment numbers reported during July. This

shortfall of demand was mirrored by the fastest rise in sub-contractor

availability since November 2010 and another decline in hourly rates

charged."